Introduction

In this blog post, we will discuss the topic of “Beware of Fake Breakouts” and provide valuable insights into how it relates to the US Stock market. As traders and investors, we are all familiar with the concept of a breakout, but not all breakouts are genuine. Traders need to be aware of the possibility of a fake breakout, which can be costly. This post explores the causes of fake breakouts, how to identify them, and most importantly, how to protect yourself from their consequences. We will provide practical tips and strategies to help you avoid falling victim to fake breakouts and make informed trading decisions. So, whether you are a seasoned trader or just starting, join us as we delve into the topic of fake breakouts and learn how to navigate the US Stock market with confidence. Don’t miss out on this valuable information that can potentially save you from significant losses.

Discover what a breakout is and how it impacts US Stock market

A breakout occurs when the price of an asset breaks through a key level of support or resistance. This can signal a significant shift in market sentiment and lead to new trends and opportunities.

As traders and investors, we are all familiar with the concept of support and resistance levels. These are price points where the market has shown a tendency to either bounce back or reverse direction. When the price of an asset breaks through one of these levels, it is considered a breakout.

Breakouts can be bullish or bearish, depending on the direction of the price movement. A bullish breakout occurs when the price breaks through a resistance level and continues to rise. This can signal that buyers are in control and that the asset is likely to continue its upward trend.

On the other hand, a bearish breakout occurs when the price breaks through a support level and continues to fall. This can signal that sellers are in control and that the asset is likely to continue its downward trend. They can signal the start of new trends and provide opportunities for traders to enter or exit positions. However, not all breakouts are genuine, and traders need to be aware of the possibility of a fake breakout.

A fake breakout occurs when the price briefly breaks through a key level but then quickly reverses direction. This can be caused by a variety of factors, including market manipulation, news events, or simply a lack of follow-through from buyers or sellers.

To protect yourself from fake breakouts, it is important to use a combination of technical analysis and risk management techniques. This can include setting stop-loss orders, using multiple time frames to confirm breakouts, and waiting for confirmation before entering a trade.

Uncover the Truth Behind Fake Breakouts and Why They Matter

A breakout is often accompanied by a surge in trading volume and is seen as a potential signal of market movement, trapping traders who entered the market in the wrong direction. Fake breakouts can be costly, and it is crucial to understand why they matter and how to protect yourself from them.

Another reason why fake breakouts matter is that they can be caused by market manipulation. Unscrupulous traders or market makers may use tactics such as spoofing or painting the tape to create the illusion of a breakout. Spoofing involves placing large orders with the intention of canceling them before they are executed while painting the tape involves making trades to manipulate the perception of market activity. By creating a fake breakout, these traders can profit at the expense of others.

Finally, traders can stay informed about market news and events that may impact the asset they are trading. Major announcements, such as earnings reports or policy changes, can create volatility in the market and impact the validity of a breakout signal.

As a trader or investor, understanding the truth behind fake breakouts can help you navigate the market with confidence. It is essential to understand why they matter and how to protect yourself from them. Remember, in the world of trading, knowledge is power.

Understand the factors that cause breakouts in the US stock market

There are several factors that can cause breakouts in the US stock market.

These can include changes in market fundamentals, such as economic data releases or company earnings reports.

Technical factors, such as chart patterns or indicators, can also play a role in causing breakouts.

In addition, market sentiment and investor psychology can also contribute to breakouts. For example, if there is a high level of bullish sentiment in the market, this can increase the likelihood of a bullish breakout.

To bring this to a close, understanding the factors that cause breakouts in the american stock market can help you make informed trading decisions. By incorporating this knowledge into your trading strategy, you can take advantage of new trends and opportunities in the market.

How to Avoid Fake Breakouts | How can traders protect themselves from fake breakouts?

Avoiding fake breakouts is crucial for successful trading in the US market. So here the very simple techniques by hich you won’t be trapped anymore:

Here are some tips on how traders can avoid falling victim to this type of manipulation:

- Do your research: Before making any trades, make sure to conduct thorough research on the company and the market. Look for any signs of unusual activity or suspicious patterns.

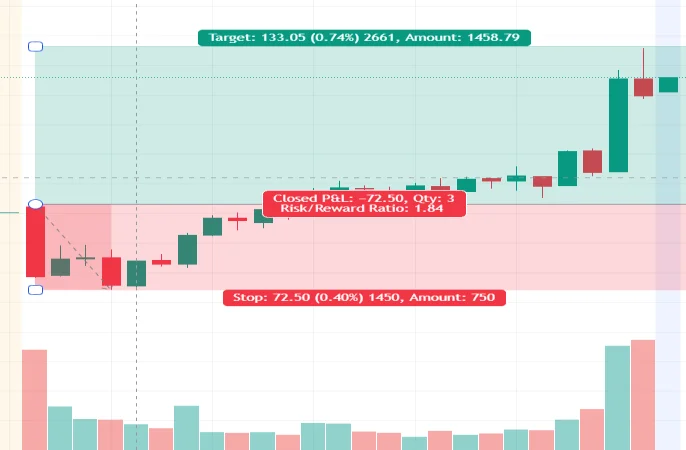

- Always wait for the retest levels after any breakout from any strategy; waiting for confirmation before entering a trade could be one of the best strategy for avoiding fake breakout. This can be costly for traders who enter or exit positions based on the initial breakout.

- Effective risk management techniques.

- Putting stop loss orders to limit potential losses. Stop-loss orders are instructions to automatically sell or buy an asset when it reaches a specified price, protecting traders from significant losses if the market quickly reverses. Remember- don’t blindly be dependent on stop loss order because sometimes the order does not execute because of market volatility or the broker’s technical fault. So it’s also so much important to find a good broker before you put your hard-earned money.

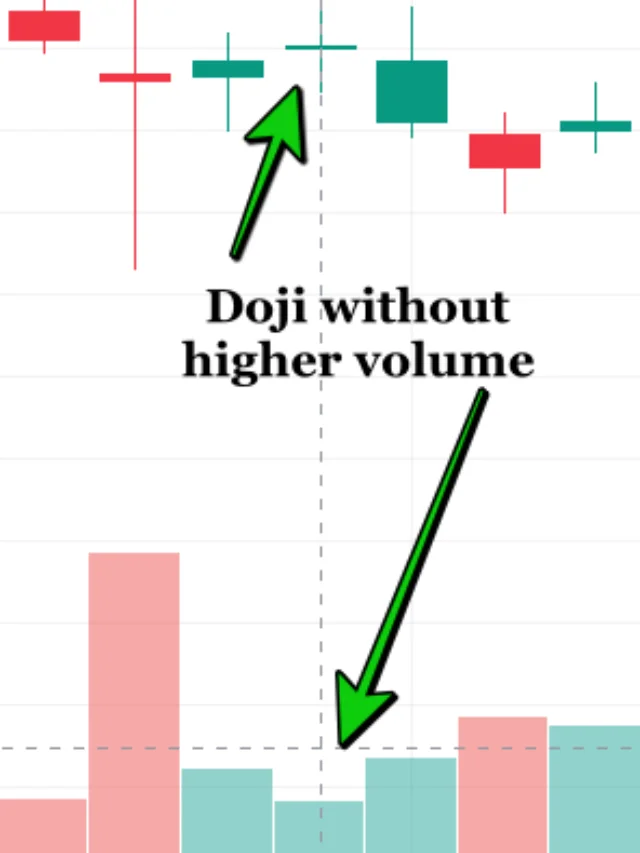

- Watch out for sudden spikes in volume: Sudden spikes in volume can be a red flag for fake breakouts. Look for consistent and gradual increases in volume to confirm a breakout.

- Beware of rumors: Rumors can be a powerful tool for manipulating the market. Be skeptical of any information that cannot be verified through reputable sources.

- Stay informed: Stay up-to-date on news and events that may impact the market. Keep an eye on financial news and regulatory announcements to avoid falling victim to fake breakouts.

- Use technical analysis/indicators such as moving averages, trendlines, and volume can provide additional insight into market activity, helping to distinguish genuine breakouts from fake ones.

It’s important to note that no single technical indicator can be relied upon to confirm a breakout. Traders should use a combination of indicators and conduct thorough research to make informed trading decisions. Additionally, it’s important to remember that technical indicators can also be manipulated, so it’s important to stay vigilant. - Fundamental analysis, such as economic data releases or company earnings reports.

- Using multiple time frame for the confirmation before taking trade.

- Understanding Risk-to-Reward ratio before entering any trade.

By following these simple tips/methods, traders can reduce their risk of falling victim to fake breakouts and improve their chances of success in the US stock market. It is important for traders to remain vigilant and to always prioritize safe trading strategies.

The Risks of Trading Fake Breakouts

Trading fake breakouts can be a risky venture for traders in any market, and particularly in the US market where volatility is often high.

The risks of trading fake breakouts are significant. Traders who enter the market based on a fake breakout signal may face substantial losses, particularly if they use leverage or fail to implement effective risk management strategies. Additionally, trading fake breakouts can lead to a loss of confidence and trust in the trading strategy, making it difficult to make informed trading decisions in the future.

Utimately, the risks of trading fake breakouts are significant, and traders must be able to identify and avoid them to succeed in the US market. By using technical analysis and effective risk management strategies, traders can make informed trading decisions and minimize the risks associated with trading fake breakouts. Understanding the risks associated with trading fake breakouts is essential for effective risk management and successful trading in the US market.

How trading fake breakouts can damage your reputation

Trading fake breakouts can damage a trader’s reputation in the US market. Traders who engage in manipulative trading practices risk losing the trust and respect of their peers, investors, and regulators.

One way that trading fake breakouts can damage a trader’s reputation is by violating ethical and professional standards. Trading based on false signals and misleading information can be seen as dishonest and unethical and can result in a loss of trust from investors and colleagues.

Trading fake breakouts can also harm a trader’s financial standing. Engaging in manipulative trading practices can lead to significant losses, which can be difficult to recover from. This can further damage a trader’s reputation and make it difficult to attract new clients or investors.

In conclusion, trading fake breakouts can have serious consequences for a trader’s reputation in the US market. It is important for traders to engage in safe trading practices and to avoid manipulative trading strategies to protect their reputations and gain the trust of investors and regulators.

Examples of successful trades made by avoiding fake breakouts in the US stock market

Here are some examples of successful trades made by avoiding fake breakouts in the stock market:

- Tesla: In early 2020, Tesla experienced a significant price increase, with its stock price soaring to new highs. However, technical indicators suggested that the breakout was likely to fail, as the RSI was showing overbought conditions. Traders who recognized this and avoided buying into the hype were able to avoid losses when the stock price eventually declined.

- Apple: In 2019, Apple experienced a breakout that pushed its stock price to new highs. However, the breakout was not supported by strong fundamentals, and technical indicators such as the MACD were showing bearish signals. Traders who recognized these signals were able to avoid buying into a false breakout and instead waited for a genuine breakout to occur later in the year, resulting in significant profits.

- Amazon: In 2018, Amazon experienced a fake breakout when its stock price briefly surpassed a key resistance level. However, technical indicators such as the RSI were showing overbought conditions, suggesting that the breakout was unlikely to continue. Traders who recognized this were able to avoid buying at the top of the false breakout and instead waited for a genuine breakout later in the year, resulting in significant profits.

- Microsoft: In 2017, Microsoft experienced a breakout that pushed its stock price to new highs. However, the breakout was not supported by strong fundamentals, and technical indicators such as the MACD were showing bearish signals. Traders who recognized these signals were able to avoid buying into a false breakout and instead waited for a genuine breakout to occur later in the year, resulting in significant profits.

- Facebook: In 2016, Facebook experienced a fake breakout when its stock price briefly surpassed a key resistance level. However, technical indicators such as the RSI were showing overbought conditions, suggesting that the breakout was unlikely to continue. Traders who recognized this were able to avoid buying at the top of the false breakout and instead waited for a genuine breakout later in the year, resulting in significant profits.

These examples demonstrate the importance of avoiding fake breakouts in the stock market. By recognizing when a breakout is genuine and when it is likely to fail, traders can make more informed decisions and increase their chances of success.

Remember, trading in the stock market involves risk, and it’s important to have a well-defined investment strategy and risk management plan in place to minimize losses and maximize profits.

Examples of unsuccessful trades caused by ignoring fake breakouts

Ignoring fake breakouts can lead to significant losses in the stock market. It is essential to understand the importance of avoiding fake breakouts and learning from examples of unsuccessful trades. Here are some examples of trades that resulted in losses due to ignoring fake breakouts:

- Tesla Inc. (TSLA) – In October 2018, TSLA had a breakout above the resistance level of $360 per share. However, it was a fake breakout, and the stock price fell below the breakout level, resulting in significant losses for traders who bought at the breakout. Those who ignored the fake breakout and waited for confirmation could have saved themselves from substantial losses.

- GoPro Inc. (GPRO) – In 2015, GPRO had a breakout above the resistance level of $60 per share. However, the breakout was a fake one, and the stock price fell sharply, resulting in significant losses for traders who bought at the breakout. Those who waited for confirmation and identified the fake breakout could have avoided losses.

- Twitter Inc. (TWTR) – In July 2015, TWTR had a breakout above the resistance level of $38 per share. However, the breakout was a fake one, and the stock price fell below the breakout level, resulting in losses for traders who bought at the breakout. Traders who identified the fake breakout and waited for confirmation could have avoided losses.

These examples demonstrate the significance of identifying fake breakouts and avoiding losses. Traders who rely solely on technical indicators to identify breakouts may end up ignoring other essential factors, such as the company’s fundamentals, news, and market conditions.

Additionally, traders can avoid common mistakes specific to the US stock market, such as following the hype and speculation surrounding certain stocks.

For example, the GameStop stock price skyrocketed in January 2021 due to a Reddit-driven short squeeze. However, the stock price eventually fell, resulting in significant losses for traders who bought at the peak.

To recapitulate, learning from examples of unsuccessful trades caused by ignoring fake breakouts is crucial for success in the stock market. Traders should avoid relying solely on technical indicators, conduct fundamental analysis, and avoid common mistakes specific to the US stock market. By doing so, they can make informed decisions and avoid significant losses in their trades.

Conclusion

Avoiding fake breakouts in the US stock market is a crucial aspect of successful trading. As a recap, it is essential to understand what a breakout is, how to identify it, and how to differentiate it from a fake one. A fake breakout can lead to significant losses and damage to one’s reputation.

It is essential to conduct both technical and fundamental analysis and avoid common mistakes specific to the US market. Technical analysis involves using charts and technical indicators to identify trends and predict future price movements. On the other hand, fundamental analysis involves evaluating a company’s financial health, including its revenue, earnings, debt, and management.

Finally, it is crucial to avoid common mistakes specific to the US stock market, such as trading on rumors and ignoring economic indicators. The US stock market is heavily influenced by economic data and news, and traders need to stay informed and evaluate how such factors may impact their trades.

It is also important to note that trading requires a certain level of skill and experience. While there are strategies that can help traders avoid fake breakouts, there is no guaranteed formula for success. Traders should continue to educate themselves and stay up to date on market trends to make informed decisions.

Additionally, it is crucial to have a solid risk management plan in place. Traders should always be prepared for the possibility of losses and have a plan in place to minimize those losses. This can include setting stop-loss orders and limiting the amount of capital invested in a single trade.

FAQ: How to avoid fake breakout in Stock market

Q: What is a fake breakout?

Ans : A fake breakout occurs when the price of a stock appears to break through a support or resistance level but then quickly reverses back to its original position. This can be caused by market manipulation or a lack of sufficient buying or selling pressure.

Q: What are the risks of trading fake breakouts?

Ans : Trading fake breakouts can lead to significant losses and damage your reputation as a trader. It is important to have a solid risk management plan in place to minimize the possibility of losses.

Q: How can I identify fake breakouts?

Ans : One way to identify fake breakouts is to use technical indicators such as volume and momentum indicators. Another way is to conduct fundamental analysis to ensure that the stock’s underlying fundamentals support its price movement.

Q: What are some common mistakes traders make when trying to avoid fake breakouts?

Ans : Common mistakes include chasing a stock that appears to be breaking out without conducting proper analysis, failing to set stop-loss orders, and ignoring market trends.

Q: How can I avoid fake breakouts in the US Stock market?

Ans : Some strategies to avoid fake breakouts include conducting fundamental analysis, using technical indicators, avoiding common mistakes specific to the US Stock market, and having a solid risk management plan in place.

Q: Is there a guaranteed formula for success in trading?

Ans : While there are strategies that can help traders avoid fake breakouts, there is no guaranteed formula for success in trading. Traders should continue to educate themselves and stay up to date on market trends to make informed decisions.

Q: What is the importance of risk management in trading?

Ans : Risk management is crucial in trading because it helps minimize the possibility of losses. Traders should always be prepared for the possibility of losses and have a plan in place to minimize those losses.

Q: How to trade fake breakouts?

Ans : Trading fake breakouts can be a high-risk, high-reward strategy, and it’s crucial to have a solid understanding of the market and a well-defined trading plan to minimize your risks. It’s also essential to keep your emotions in check and not to let fear or greed guide your trading decisions. In short:

1) Use technical indicators

2) set stop-loss orders

3) Look at the trading volume

4) Stay up-to-date on market news

5) Begin with small trades and gradually increase your position size as you gain experience and confidence in your strategy.